stock option exercise tax calculator

Non-qualified stock options or NSOs are a type of stock option that does not qualify for the. How much are your stock options worth.

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Please enter your option information below to see your potential savings.

. To make it as easy as possible weve built an online calculator that crunches the numbers for you and. Your Equity Administration Deserves Industry-Leading Strategies from Fidelity. When logging into your stock option portal you should have four options to choose from with your 100 stock options.

Cash secured put calculator addedcsp calculator. Stock Option Tax Calculator Calculate the costs to exercise your stock options - including taxes. Ad Get the capital you need to exercise early.

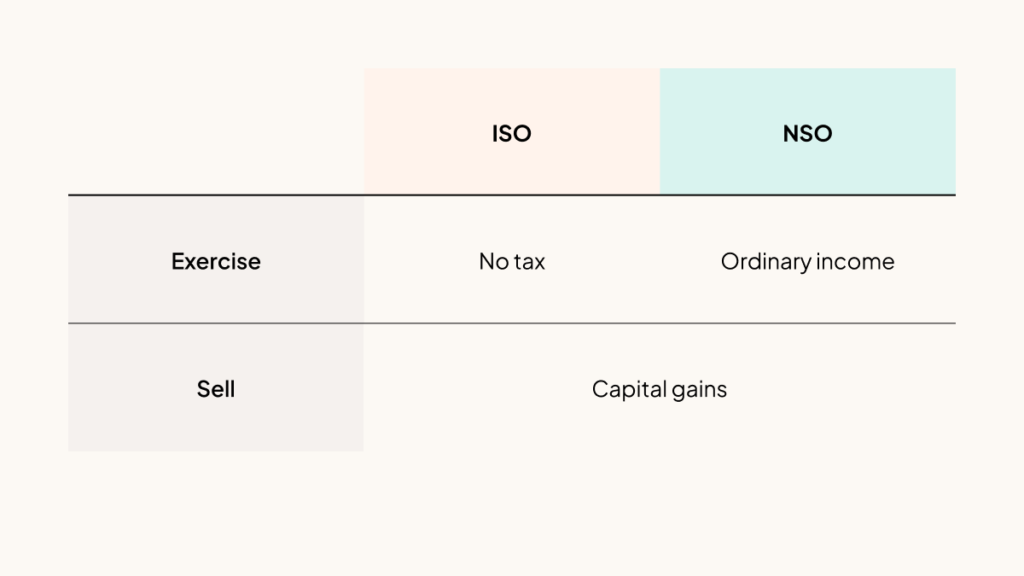

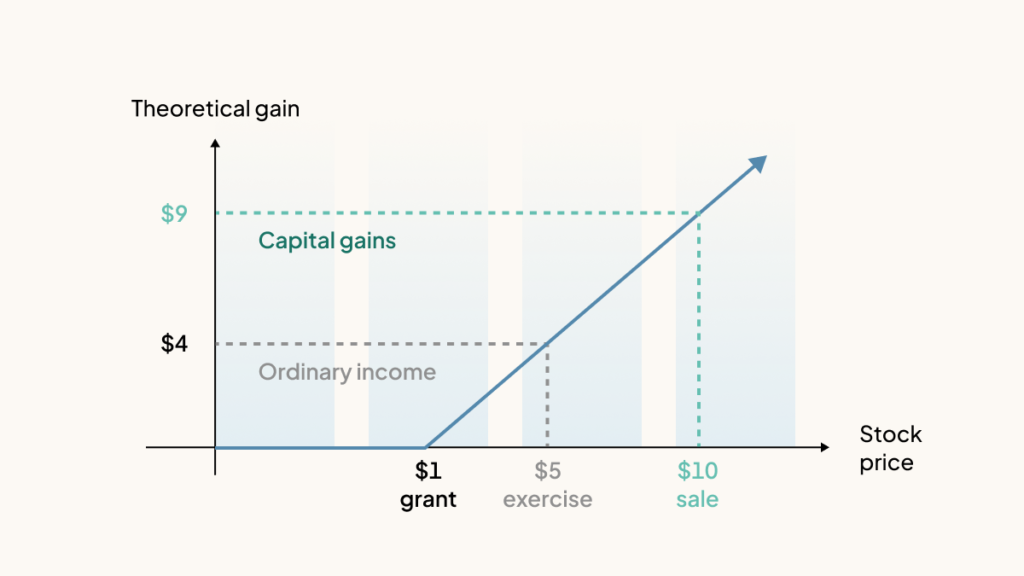

Cash secured put calculator addedcsp calculator. If you decide to exercise when the stock price is 5 your theoretical gain is 4 per share. Option Exercise Calculator This calculator illustrates the tax benefits of exercising your stock options before IPO.

Click to follow the link and save it to your Favorites so. Incentive stock option iso calculator. Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You.

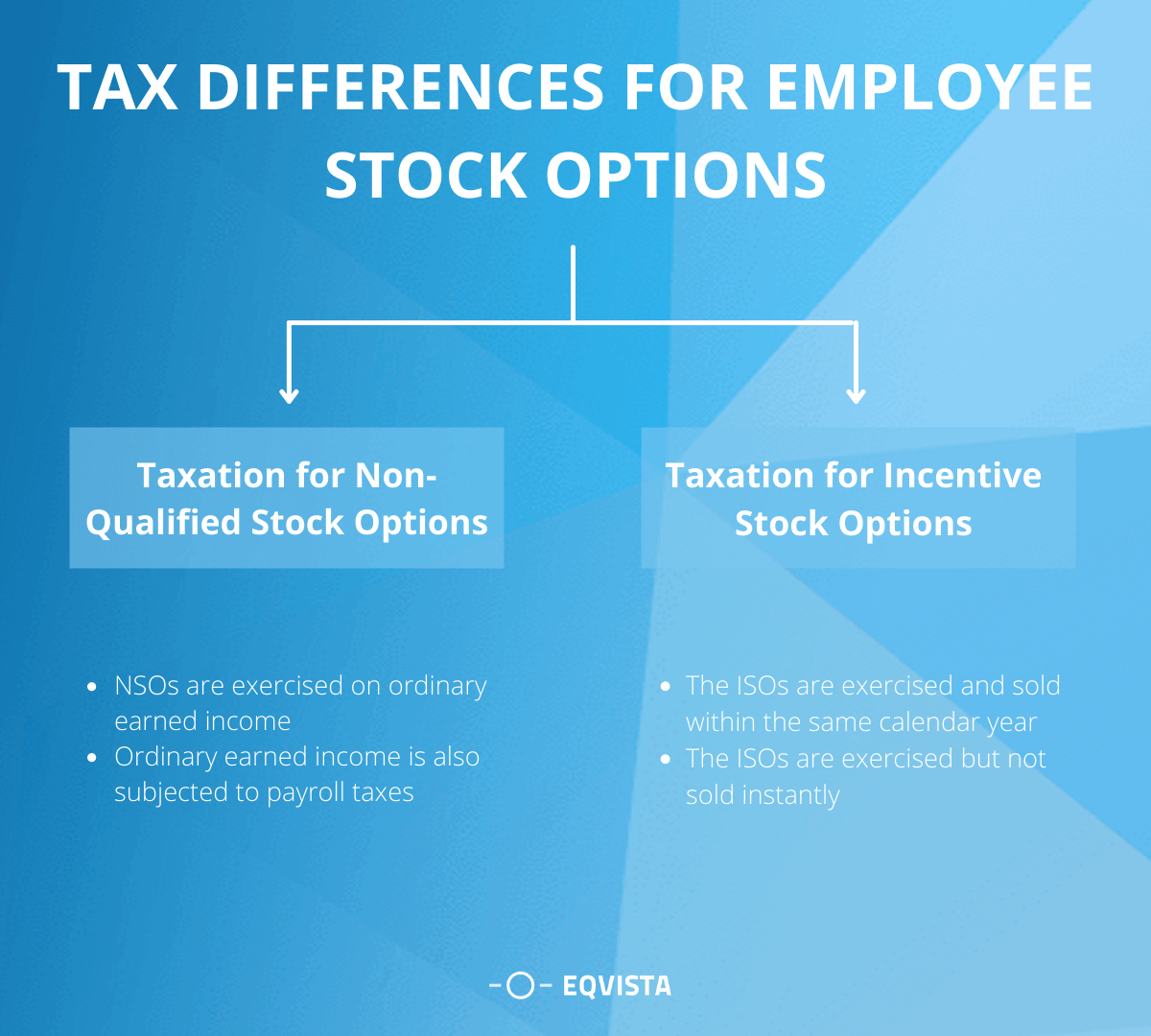

Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios. NSO Tax Occasion 1 - At Exercise.

Ad See how Invesco QQQ ETF can fit into your portfolio. Ad There are limited options for deferring capital gains taxes. Purchase your shares of.

Minimize capital gains from sale of stock by investing in high-growth urban markets. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Access the Nasdaqs Largest 100 non-financial companies in a Single Investment. Get ready to own your shares in the company youve helped build. Equitybee covers all costs including tax.

When your stock options vest on January 1 you decide to exercise your shares. The stock price is 50. Use the Stock Option Tax Calculator to calculate your estimated tax bill.

The AMT is complicated and it depends on your income tax brackets etc. Incentive stock options or ISOs are a. On this page is an Incentive Stock Options or ISO calculator.

You pay the stock. Get started Know your options. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

AMT Calculator Exercise incentive stock options without paying the alternative minimum tax. Ad Get the capital you need to exercise early. The Stock Option Plan specifies the employees or class of employees eligible to receive options.

As the stock price grows higher than 1 your option payout increases. Your taxes will be paid on 10 minus 5 equaling 5 per. Equitybee covers all costs including tax.

Ad Fidelity Has the Tools Education Experience To Enhance Your Business. On this page is a non-qualified stock option or NSO calculator. This permalink creates a unique url for this online calculator with your saved information.

Ad Help Determine Which IRA Type Better Fits Your Specific Situation. Stock option exit calculator See how much your stock could be worth See how much you might potentially bring home if your company IPOs or exits. Calculate my AMT Reduce my AMT - ISO Planner Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022.

Its free Compare the final tax bill with the amount of withholding that your company provides. Ad Learn how VIX options and futures could provide unique portfolio diversification. Get ready to own your shares in the company youve helped build.

Ad With over 40 years experience in options trading we have a robust set of tools. Your taxes will be paid on 10 minus 5 equaling 5 per. The Stock Option Plan specifies the total number of shares in the option pool.

Use our free Stock Option Tax Calculator for taxes on exercise. Incentive stock option iso calculator. Our tools and algorithms help investors design option strategies.

Your stock options cost 1000 100 share options x 10 grant price. Use our free Stock Option Tax Calculator for taxes on exercise and the Stock Option Exit Calculator for taxes on sale What are ISOs.

Stock Options 101 The Essentials Mystockoptions Com

Rsu Taxes Explained 4 Tax Strategies For 2022

Tax Planning For Stock Options

Rsu Taxes Explained 4 Tax Strategies For 2022

List Of Shipping Documents That Are Required For The Import Export Process Incodocs Import Exports Database Business B Trading Export Health Motivation

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

Restricted Stock Units Jane Financial

Employee Stock Options And 409a Valuations Eqvista

How Stock Options Are Taxed Carta

How Stock Options Are Taxed Carta

How To Fix Thinkorswim S Delayed Data And Get Real Time Data For Free Credit Card Help Real Time Financial Goals

Exercise Cartoon 808 Andertoons Exercise Cartoons Gym Humor Biking Workout Gym Clothes Cheap

How To Give Stock As A Gift And Why Tax Pros Like The Idea Nerdwallet Capital Gains Tax Retirement Calculator Investment Advisor

What Is An Annuity Investing For Retirement Annuity Investing Money

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)